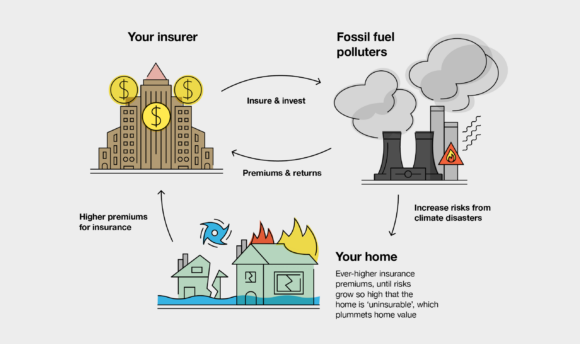

Climate Votes has published an investors’ brief highlighting the insurance sector’s high exposure to climate-related risks and identifying actionable opportunities that investors can take this AGM season to encourage mitigating these risks.

Shareholders are increasingly concerned about the climate and human rights risks facing property and casualty insurance companies that underwrite energy projects and companies. The analysis focuses on three North American insurers that face unique and serious climate risks due in part to their outsized exposure to fossil fuels:

- Chubb

- Travelers

- The Hartford

Investors can encourage insurers to lower their exposure to climate risk this shareholder season by taking the following proxy voting actions:

- Phaseout of new fossil fuel exploration and development: These proposals call on insurers to phase out underwriting projects engaging in new fossil fuel exploration and development, which is misaligned with 1.5 ̊C global warming pathways.

- Disclose and reduce greenhouse gas emissions from underwriting activities, aligned with a 1.5°C pathway: These proposals call on insurers to issue a report addressing if and how they intend to measure, disclose, and reduce the GHG emissions associated with underwriting, insuring, and investment activities in alignment with the Paris Agreement’s 1.5°C goal, requiring net zero emissions Racial equity audit: This proposal call on Travelers to tackle racial injustice through its internal and external policies and practices.

- Free, Informed, Prior Consent (FPIC): This proposal calls on Chubb to evaluate the human rights risks and impacts in its underwriting decisions with particular attention to the extent to which Free, Prior, and Informed Consent, as outlined by the UN Declaration on the Rights of Indigenous Peoples, is considered in underwriting practices.