Rainforest Action Network’s Assessment of Chubb’s Climate Commitments

On March 22, 2023, Chubb announced a new suite of policies to restrict underwriting oil and gas extraction based on conservation and methane emissions criteria. Chubb will not insure oil and gas extraction projects that are located in specific protected areas or do not have evidence-based plans to reduce methane emissions.

This marks the first policy from a U.S. insurer that applies to conventional oil and gas underwriting, and follows years of campaigning for Chubb to heed the warnings of impacted communities and climate scientists.

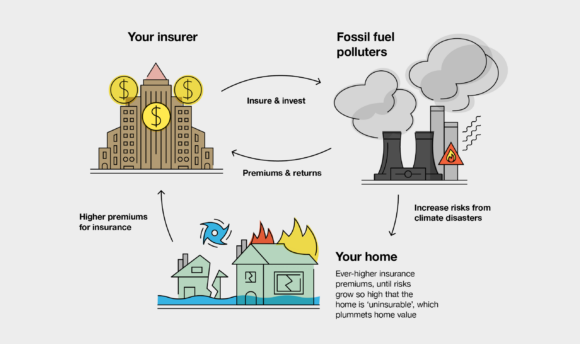

RAN analyzed the commitments, concluding that while Chubb’s policy is a significant step forward and a new standard among U.S. insurers, the insurer is not yet aligned with a 1.5˚C pathway and remains far from best practice for coal, oil, and gas policies among global insurers.

Under the new policy Chubb can still continue underwriting many new oil and gas extraction projects, as well as companies exploring for and developing new fossil reserves. In addition, because the policy focuses just on the production side, the company can still insure midstream projects (e.g. pipelines) and downstream infrastructure (e.g. power plants). Significantly, Chubb has not adopted a framework or policy for evaluating human rights risks, in particular around the rights of Indigenous Peoples, in its underwriting portfolio.

Furthermore, by only ruling out the expansion of oil and gas drilling on conservation lands, Chubb is able to keep insuring the buildout of oil and gas extraction in areas that are already bearing the brunt of industrial development, concentrating the disproportionate burden of fossil pollution in frontline and fenceline communities, which are largely communities of color.

Spotlight Projects & Regions

While Chubb’s conservation standards clearly rule out some proposed oil and gas drilling, the analysis finds that it is not applicable to many other expansion projects or to companies expanding oil and gas. Chubb is still at risk of insuring many emissions-intensive, environmentally-destructive projects, as well as human rights abuses, due to gaps and uncertainties in the policy:

- The policy does rule out insurance for oil and gas extraction in the Arctic National Wildlife Refuge, as the Gwich’in Steering Committee celebrated this week! However, it does not apply to ConocoPhillips’ Willow Project, nor to other drilling projects in the North Slope of Alaska

- Chubb’s policy does not apply to midstream or downstream oil and gas infrastructure, so it can still insure pipeline projects like the East African Crude Oil Pipeline (EACOP).

- It is unclear how Chubb will apply the policy to oil and gas extraction projects that are only partly overlapping with protected areas, as is the case in proposed oil and gas extraction projects in the Democratic Republic of Congo (30 oil and gas blocks were auctioned off in July 2022), Uganda (Total’s Tilenga oil field), and the Peruvian Amazon (Block 8 and Block 64).

- Chubb can continue to provide insurance at the company level for oil and gas corporations that are expanding oil and gas extraction in sensitive regions, such as Brazil’s Petrobras, even if it rules out coverage for specific projects due to this criteria.

The analysis provides more detail on specific fossil fuel expansion projects and regions and how this policy applies.

Looking Ahead

The report further outlines what steps Chubb should take to meet its commitment to align with climate science and the goals of the Paris Agreement. We will be closely monitoring additional standards that Chubb plans to develop for IUCN category VI areas, along with Key Biodiversity Areas, mangrove forests, global peatlands, and Arctic lands that are not currently listed in the World Database on Protected Areas. We will also be looking for further details on its evaluation metrics for clients’ methane emissions reduction plans, as well clarity on engagement timelines and sanctions for non-compliance.

RAN and the Insure Our Future network will continue to call on Chubb to align with a safe climate by meeting the following demands:

- Immediately cease insuring new and expanded coal, oil, and gas projects.

- Immediately stop insuring any new customers from the fossil fuel sector which are not aligned with a credible 1.5ºC pathway, and stop offering any insurance services which support the expansion of coal, oil and gas production at existing customers. Within two years, phase out all insurance services for existing fossil fuel company customers which are not aligned with such a pathway.

- Immediately divest all assets, including assets managed for third parties, from coal, oil, and gas companies that are not aligned with a credible 1.5ºC pathway.

- By July 2023, define and adopt binding targets for reducing your insured emissions which are transparent, comprehensive and aligned with a credible 1.5ºC pathway.

- Immediately establish, and adopt as policy, robust due diligence and verification mechanisms to ensure clients fully respect and observe all human rights, including a requirement that they obtain and document the Free, Prior, and Informed Consent (FPIC) of impacted Indigenous Peoples as articulated in the UN Declaration on the Rights of Indigenous Peoples.

- Immediately bring stewardship activities, membership of trade associations and public positions as a shareholder and corporate citizen in line with a credible 1.5ºC pathway in a transparent way.