Despite Climate Policy, MetLife is on a Coal, Oil, and Gas Investing Spree in Eastern Europe

By Elana Sulakshana (@esulakshana), Energy Finance Campaigner at Rainforest Action Network, and Kuba Gogolewski, Senior Finance Campaigner at Fundacja Rozwój TAK – Odkrywki NIE

Last summer, MetLife became the first major US life insurer to adopt a policy restricting its fossil fuel investments, citing the risks of climate change and following the 60+ big insurers that have already divested from coal in some form. MetLife pledged that it would make no new investments in some coal and tar sands oil companies from its general account.

Over here at Insure Our Future, we welcomed the move but pointed to the “major loopholes” and urged the company to take action “commensurate with the urgency and scale of the climate crisis.” We’re following up on that demand, in light of new research demonstrating that MetLife is exploiting these major loopholes and has been pouring millions of dollars into coal companies in Eastern Europe.

Back in 1999, MetLife became a manager of one of the Polish pension funds (known as MetLife OFE), and it has doubled down on investing in coal in recent years. Insure Our Future campaigners in Europe dug into the pension fund data and have the receipts to prove MetLife’s dirty dealings in coal, oil, and gas.

The DIRTY DEALINGS

- Among all Polish pension funds, MetLife OFE has the highest percentage of coal shares and bonds in its assets under management, with nearly 6% at the end of 2020. There’s no good reason to be so heavily invested in coal; fellow insurer Generali operates a pension fund in the same market but with only 2.5% in coal (Generali also has a much stronger coal divestment policy than MetLife, as we found in the 2020 Insurance, Fossil Fuels, and Climate Change Scorecard).

- Unsurprisingly, MetLife OFE also has the highest share of investments in fossil fuels broadly of all the Polish pension funds. The share of the fund in coal, oil, and gas stood at 16.45% at the end of 2020. For comparison, the fund managed by Allianz had significantly less, with 10.3% of shares and bonds of fossil fuel companies (though that is, of course, still way too high!).

- In 2020, MetLife OFE actively loaded up on Polish coal companies. It bought almost 4 million shares of PGE, a coal-intensive utility, and poured money into Tauron, a coal mining and power corporation. Neither PGE nor Tauron have credible decarbonization plans in line with a 1.5ºC pathway. In fact, PGE just applied to extend its mining license until 2044 for a massive, and controversial, open pit coal mine in the southwest of Poland. The air and water pollution associated with the project has driven the Czech Republic to bring a case against Poland to the European Court of Justice at the end of February, representing the first case between EU Member States on environmental grounds.

- Throughout last year, as COVID-19 devastated the oil industry, MetLife OFE also actively expanded investments in oil and gas. It purchased additional shares in CEZ, a Czech power conglomerate, and other oil and gas companies in Central and Eastern Europe.

This year is a critical year, with the UN climate conference in November marking six years since the Paris Agreement was signed. The Paris Agreement’s implementation depends on commitments from financial actors, including pension funds. It’s way past time for MetLife to be supporting the expansion of coal, oil, and gas infrastructure through its investments.

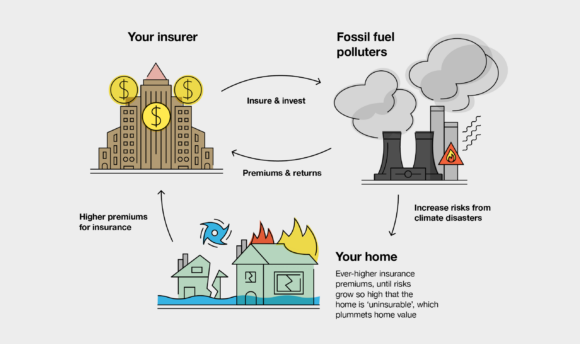

Fossil fuel investing is also a risky economic move. As the COVID-19 pandemic demonstrated, the fossil fuel industry is on shaky footing, and these are not stable or smart long-term investments. Demand for coal is plummeting, and for the first time this past year, renewables surpassed the sector in terms of electricity generation in the US. Oil and gas is not faring much better; in 2020 alone, oil and gas giant ExxonMobil reported a total loss of $22.4 billion.

Pension fund managers are waking up to the bleak prospects for fossil fuels. In January 2021, the New York State Common Retirement Fund divested its $226 billion portfolio from fossil fuels, which included shedding $1 billion alone in Exxon Mobil. Tom DiNapoli, the New York State comptroller, who oversees the state’s fiscal affairs, stated: “New York State’s pension fund is at the leading edge of investors addressing climate risk because investing for the low-carbon future is essential to protect the fund’s long-term value.”

Our DemandsFor the health of the planet and communities globally impacted by polluting energy, as well as the Polish citizens dependent on returns in these pension funds, we urge MetLife to take the following steps:

- Reduce the exposure of its Polish managed pension and investment funds to fossil fuel companies in line with a 1.5ºC pathway. That means divesting from any company that is expanding coal, oil, or gas infrastructure and does not have a credible plan to decarbonize rapidly.

- Expand the scope of its policy to cover all third-party managed assets, following the example of AXA Investment Management, who recently expanded its sustainable investment policy to 100% of its assets under management.

A recent study found that pollution from coal, oil, and gas causes one in five premature deaths globally. MetLife, a life insurance company that claims to “help people live better, healthier lives” has no business investing in these dangerous, polluting fossil fuels.

Follow us on Twitter @Insure_Future and contact Sulakshana at sulakshana@ran.org for more information or to arrange a meeting with our team.