Insurance giants AIG, Berkshire Hathaway, Chubb, Fairfax Financial, Markel, The Hartford, and Travelers faced shareholder resolutions, questions from concerned investors and activists, and demonstrations outside of their general meetings. Concerned investors and activists focused their attention on these North American insurers in the past month over insurers’ lack of due diligence with respect to Indigenous rights and regarding their own contributions to climate change through their underwriting and investments.

Investors filed shareholder resolutions at Berkshire Hathaway, Chubb, Markel, and Travelers.

Trillium’s proposal to Travelers was the sole proposal focused on human rights, calling for the company to disclose how human rights risks were evaluated and incorporated into the company’s underwriting. This is relevant because insurers’ business activity can include human rights risks if they have not done due diligence of their insureds to ensure that, for example, an energy infrastructure project that an insurer is underwriting is not violating rights of local Indigenous communities to Free, Prior, and Informed Consent as enshrined in the UN Declaration on the Rights of Indigenous Peoples.

Insuring human rights violations

Around the world, energy projects from the East African Crude Oil Pipeline, to oil development in Alaska’s Arctic region, to the buildout of the Liquid Natural Gas (LNG) export terminals in the U.S. Gulf Coast directly affect and harm local and Indigenous communities who often have not granted permission or even been properly consulted about projects that could harm their health, threaten their livelihoods, or jeopardize vital resources such as drinking water.

With a few exceptions, the insurance industry lags woefully behind in its efforts to assess and incorporate human rights risk into underwriting activities. Insurers need to immediately start engaging with stakeholders on these issues or risk legal or other action from local communities, civil society organizations, and investors.

Investors are increasingly concerned about fossil fuel underwriting and investments

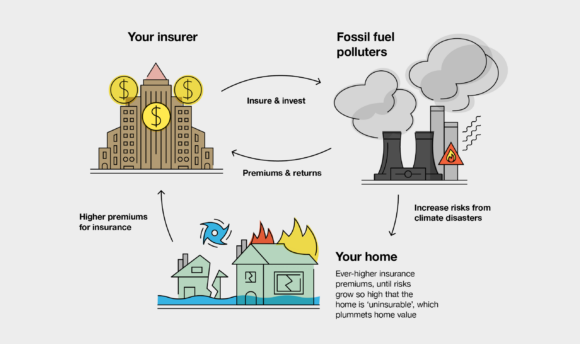

The remaining proposals called for disclosure of the insurers’ contributions to climate change through their underwriting and investments (CB, BH, MKL, and TRV) and at Travelers, an additional proposal called for disclosure of how the company is engaging its energy clients to reduce their methane emissions. Notably, the emissions resolution garnered 28% support from Chubb’s investors, 36% support from Markel’s investors, and support from nearly 40% of Berkshire Hathaway’s independent investors. Climate-related resolutions have been filed for the past several years with most of these insurers, and reflect investors’ growing concern about the insurers’ continued financial support of the fossil fuel sector that is driving the very crisis that is presenting major threats to property and casualty insurers.

Green Century Shareholder Advocate Andrea Ranger summed it up:

“As investors, we know there are short-term rewards for providing insurance to fossil fuel interests. However, the long-term consequences of short-term decisions is what we’re concerned about. Climate change has a very long tail, and we want insurers to prevent, not worsen, this looming threat.”

Climate discourse dominates general meetings

Investors and advocates also questioned company management at AIG, Chubb, Fairfax Financial, The Hartford, and Travelers on climate-related issues at nearly half a dozen insurers’ general meetings across North America this year. Several questions from attendees included concerns about insurers’ involvement in controversial and risky LNG export projects in the U.S. Gulf Coast. Fairfax Financial was questioned about when investors could expect a strategy to achieve net zero emissions across the company’s business. And as a reflection of the growing concern about the legal liability that insurers may face if they continue to stall on plans to adequately address climate change, Travelers CEO Alan Schnitzer was peppered with questions from multiple investors concerned with Travelers’ vulnerability to legal action if they continue to insure fossil fuels at the same rate while also facing mounting losses and shrinking markets due to climate-related events.

Demonstrations for the third year at Travelers’ Annual Meeting

Outside of Travelers’ shareholder meeting, protestors gathered for the third year in a row to highlight the company’s ongoing business with the fossil fuel sector and call for climate action. As hundreds of employees walked into the meeting, demonstrators handed out flyers and held banners and signs urging the company to address its underwriting and investments.

By and large, the insurance industry has a long way to go to align its business portfolio with the science of climate change and the recommended pathways to stay under 1.5°C global warming. But North American property and casualty insurers are in their own tier of laggards. Most companies hide behind rhetoric on sustainability that in no way matches the inadequate actions they are taking to reduce emissions from their businesses. Even at their own peril, they continue business as usual when the scientific evidence is practically screaming for them to do otherwise.

North American insurers should expect to continue to feel pressure from a variety of stakeholders – investors, local communities directly affected by the projects they are insuring, current and prospective employees, and others – unless they take decisive action that the planet needs.