Self-Described “Environmental Steward” AIG Is The Largest Coal Insurer Outside China

GLASGOW (November 3, 2021) — The U.S. insurance industry is undermining efforts to meet climate targets by continuing to support new oil and gas production, the Insure Our Future campaign reveals today in its fifth annual scorecard on insurers’ climate policies.

The scorecard shows that no North American insurers have stopped providing insurance for new oil and gas projects, despite warnings from the International Energy Agency and Intergovernmental Panel on Climate Change that the planet cannot afford any fossil fuel expansion if it is to meet the 1.5°C Paris target. Globally, only three insurers have policies on new oil and gas: France’s AXA, Italy’s Generali and Australia’s Suncorp, while 14 have tar sands exit policies.

U.S. Senator Sheldon Whitehouse (D-RI), who is in Glasgow for COP26, said: “American insurers continue to underwrite new oil and gas projects and invest in fossil fuel assets that pose a massive risk to the future of the planet, as well as to the insurance industry itself. Insurers hold a lot of influence over the future of fossil fuels, and they have an opportunity to help lead the planet to safety.”

The US$18.5 billion insurers receive in annual premiums from oil and gas is only a drop in the bucket compared to their overall revenue, and there are growing financial incentives to act. French bank Société Générale has reported that insurers with strong coal and ESG policies are adding billions to their value, and that “reducing exposure to oil and gas” could “unlock an additional ‘green premium’ for the sector.”

Ginger Cassady, Executive Director of Rainforest Action Network, said: “As the global climate crisis escalates rapidly, U.S. insurers have fallen starkly behind their global peers when it comes to taking responsibility for their central role in the fossil fuel economy. While leading global peers are exiting the coal sector and starting to restrict oil and gas business, AIG, Liberty Mutual, Travelers, and other U.S. companies continue to prop up the struggling coal industry and support the reckless expansion of oil and gas infrastructure.”

Thirty-five insurers have withdrawn cover from coal since 2017, up from 23 a year ago, including over 50% of the global reinsurance market. As a result, coal companies face soaring premiums and reduced insurance coverage. But North American insurers like AIG and Travelers continue to provide the last lifeline to an increasingly un-insurable industry, undermining the Biden administration’s efforts to accelerate the phase-out of coal.

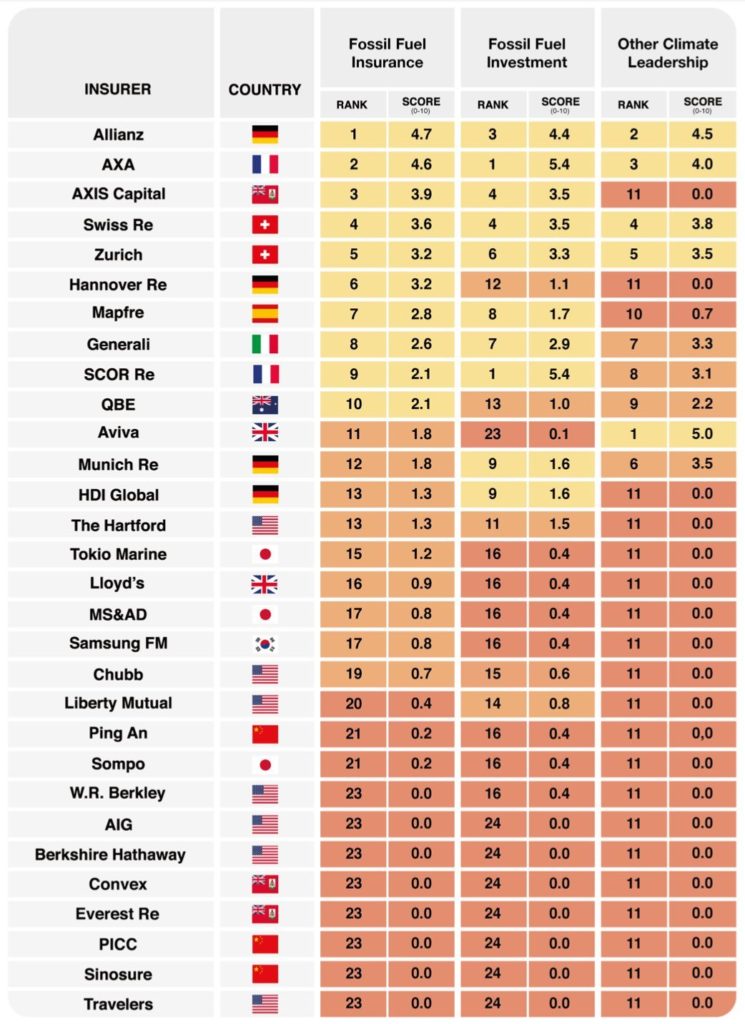

The insurance industry has a unique power to drive the transition to a low-carbon economy by only insuring projects that are consistent with limiting global warming to 1.5°C. Insuring Our Future: The 2021 Scorecard on Insurance, Fossil Fuels and Climate Change, analyzes 30 of the world’s top insurers, including 10 of the largest North American property and casualty insurers. It will be launched today at the COP26 UN Climate Summit in Glasgow.

Of the 10 North American companies evaluated:

- None have policies on oil and gas expansion, despite having the largest combined market share (43%) of global oil and gas underwriting premiums. AIG, Travelers, Chubb, Liberty Mutual, and The Hartford are among the largest global insurers of new oil and gas projects.

- Six of the 10 companies continue fossil fuel underwriting without any restrictions: AIG, Berkshire Hathaway, Travelers, W.R. Berkley, Everest Re, and Convex.

- Only two North American insurers have restricted insuring and/or investing in the tar sands oil sector: AXIS Capital and The Hartford.

- Chubb has dropped coverage of the Trans Mountain pipeline following grassroots pressure, though it has not yet adopted a formal tar sands exclusion policy.

- None of the North American insurers have commitments to ensure that clients respect Indigenous Peoples’ right to Free, Prior, and Informed Consent (FPIC) as articulated in the UN Declaration on the Rights of Indigenous Peoples.

Peter Bosshard, Global Coordinator for Insure Our Future, said: “The insurance industry is abandoning climate leadership by continuing to underwrite new oil and gas projects. The scientific consensus is clear: there is no way to avoid a climate catastrophe if we expand fossil fuel production. Most insurers recognize the threat of climate change. Action by only a few major players on oil and gas could have a significant impact.”

North American Insurers Provide A Lifeline to the Dying Coal Industry

Lloyd’s of London, the last major European insurer to cover new coal projects, adopted a coal policy in December 2020, though it lacks urgency. Japanese and Korean insurers are starting to follow Europe’s lead: MS&AD and Tokio Marine are the first Japanese insurers to end underwriting for most new coal projects. Six Korean insurers have ended insurance for coal plants following Sompo’s action last year.

This leaves North American insurers increasingly isolated in their support for coal: AIG, Travelers, Berkshire Hathaway, and W.R. Berkley in the United States, and Convex and Everest Re in Bermuda, have no restrictions on coal whatsoever. Liberty Mutual and Chubb have failed to close the remaining loopholes in their policies. One notable exception was Bermudan insurer AXIS Capital, which in October announced a phase out of all its coal business.

Restricting access to insurance and finance is a critical component of efforts to prevent future coal projects. Insurance has become the number one challenge facing coal plants in North Dakota. Premiums have soared up to 100% as fewer insurers are willing to cover the industry. In Australia, 40 insurers have ruled out covering Adani Group’s controversial Carmichael coal mine. One of the project’s suppliers was unable to obtain insurance at all.

As UN Secretary General Antonio Guterres said in June: “We need net zero commitments to cover your underwriting portfolios, and this should include the underwriting of coal – and all fossil fuels!”

AIG: Fossil Fuel Insurer of Last Resort

Insurance industry giant American International Group (AIG) refers to itself as an “environmental steward,” but remains the largest coal insurer outside of China with no restrictions on coal underwriting. The company is one of the few insurers that is able and willing to underwrite new, multi-billion dollar coal projects, despite coal accounting for less than 0.3% of its 2020 premiums. The company’s lack of restrictions on coal underwriting led the UK’s largest asset manager Legal & General Investment Management to drop its AIG holdings in June.

Hannah Saggau, Climate Finance Campaigner with Public Citizen, said: “AIG’s increasingly outsized role as a top fossil fuel insurer is indefensible. The company continues to prop up coal and enable oil and gas expansion while more and more of its peers drop these toxic drivers of climate chaos. Investors are taking note—Legal & General Investment Management was the first to dump AIG over coal underwriting, but it won’t be the last if AIG fails to take credible climate action.”

AIG remains one of the top three global insurers of oil and gas. It has failed to rule out coverage for the Trans Mountain tar sands pipeline, despite mounting grassroots pressure, or the Adani Group’s Carmichael coal mine in Australia.

About the 2021 Insuring Our Future Scorecard

Insuring Our Future: The 2021 Scorecard on Insurance, Fossil Fuels and Climate Change, focuses on 30 of the world’s top insurers, including 10 North American insurers. It is based on responses to a survey from 17 of the companies and on publicly available information where insurers failed to respond. It is published by 26 organizations from 14 countries and will be launched today at the COP26 UN Climate Summit in Glasgow.

The report and full methodology are available here:

https://insure-our-future.com/scorecard

For a full briefing on the major US insurers in the report:

US report on IOF scorecard

###

For further information please contact:

Jamie Kalliongis, Jamie.Kalliongis@sunriseproject.org or +1 314 651 7497

About Insure Our Future

The Insure Our Future campaign brings together a global network of NGOs and social movements calling for insurance companies to divest from and cease insuring coal, tar sands, oil and gas, and support the transition to clean energy. The campaign is supported by #aufstehn (Austria), Campax (Switzerland), Client Earth, Coal Action Network (UK), Connecticut Citizen Action Group (USA), Europe Beyond Coal, Fundacja “Rozwój TAK – Odkrywki NIE” (Poland), Future Coalition (USA), Indigenous Environmental Network, Instituto Internacional de Derecho y Medio Ambiente (IIDMA, Spain), Japan Center for a Sustainable Environment and Society (JACSES, Japan), Mazaska Talks (USA), Mother’s Rise Up, Public Citizen (USA), Reclaim Finance (France), Rainforest Action Network (USA), ReCommon (Italy), Reset (Czech Republic), Sierra Club (USA), Solutions For Our Climate (Korea), Stand.earth (USA/Canada), SumOfUs, The Sunrise Project, Urgewald (Germany), and Waterkeeper Alliance.