Julia Kollewe | The Guardian | December 3, 2018

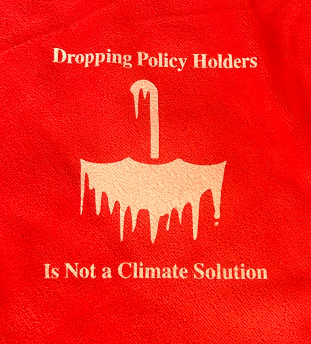

UK and US insurers are lagging far behind European firms when it comes to divesting from coal-heavy businesses and refusing to insure them, campaigners have warned.

At least 19 major insurers holding more than $6tn in assets – a fifth of the industry’s global assets – have now divested from coal, according to a report from the Unfriend Coal campaign, which represents a coalition of a dozen environmental groups including Greenpeace, 350.org and the Sierra Club.

This is up from $4tn – equivalent to 13% of global assets – that were covered by coal exclusion policies a year ago. The study rates 24 of the world’s biggest insurers on their efforts to distance themselves from the fossil fuel industry.

A growing number of insurers are taking action, faced with mounting losses from disasters such as hurricanes and wildfires, whose frequency and severity has increased due to a warming climate. Global losses reached $337bn last year, including insured losses of $144bn.

The report found that Europe’s four biggest insurers have restricted insurance for coal. Germany’s Allianz and Italy’s Generali limited underwriting this year, while French firm Axa tightened its policy further.

A third of the global reinsurance market has also restricted cover for coal, with the reinsurance firms Swiss Re and Munich Re limiting their underwriting this year.

UK insurers, though, have made less progress than European firms. Lloyd’s of London, the world’s oldest insurance market, has done nothing to encourage its syndicates to stop insuring coal or sell their coal investments, the report said, although it excluded coal from the investment strategy for its own central fund in April.

Lloyd’s said: “The Lloyd’s market is made up of more than 50 insurance companies that run almost 100 syndicates between them. These insurance companies each have their own investment policies. It is not the corporation’s role to set investment strategy for the market, although we think that by showing leadership in this area, others in the Lloyd’s market and wider insurance sector will be encouraged to follow.”

Aviva and Legal & General are focused on engaging with coal companies to create change, and only sell their coal holdings in exceptional circumstances. Neither provides insurance to coal companies, but Aviva is one of the top investors in the Polish coal industry, whose plans to build more than 7 gigawatts of new coal power are inconsistent with the goals of the Paris agreement on climate change, according to Unfriend Coal.

Unfriend Coal’s campaign coordinator, Lucie Pinson, said trying to engage with coal companies was “a waste of time” and that cutting financial ties with them was the only way forward.

Across the Atlantic, none of the nine leading US insurers have taken any action. In Japan, there are the first signs of change, as three large life insurers – Nippon Life, Dai-ichi Life and Meiji Yasuda Life – have announced they will no longer fund new coal projects.

Globally, Allianz is the only company that has pledged to cut its financial ties with coal companies completely by 2040, by stopping both underwriting and insuring in coal.

The UK insurance broker Willis Towers Watson warned in September that “finding alternative sources [of coal insurance] is likely to become increasingly challenging – especially if North American insurers begin to follow the European lead”.

The Unfriend Coal report is being presented to insurers at an insurance and climate risk conference in London, and as the UN climate change conference gets under way in Poland on Monday.