Photographs available here

San Francisco (April 11, 2022) – A coalition of Indigenous, environmental justice, and climate organizations painted a giant mural outside the RIMS 2022 RISKWORLD Opening Ceremony with a clear message to the insurance industry: “Don’t Risk Our World.”

The mural depicted a globe surrounded by creatures native to California and Alaska, as well as the fossil fuel extraction and climate disasters that are threatening ecosystems and communities across the region. It was created, in part, with paint containing the ashes of homes destroyed by wildfires in California and Colorado. It called out the hypocrisy of Chubb, Travelers, and other U.S. insurers who continue to insure fossil fuel expansion that is driving the climate crisis and harming communities, while dropping their clients who have been affected by extreme weather.

“Created with ash and clay paint, this mural is literally putting earth on top of concrete, and we are bringing in the power of the earth to transform grief into action. The design features key species that are spiritually and ecologically essential for the health of Indigenous communities and our shared ecosystems – the caribou, whooping crane, and chinook salmon – while also reflecting the devastation being caused by fossil fuel extraction and devastating wildfires in the Western US.”

RIMS is the biggest annual insurance industry conference and draws thousands of participants from across the world. Yet while the conference is focused on risk, it completely fails to address the risks associated with the industry’s role in fueling climate chaos.

The U.S. insurance industry has come under fire for supporting fossil fuel expansion projects, including coal mines, tar sands pipelines, and Arctic drilling. Frontline and Indigenous communities have been leading efforts to engage with companies on their destructive climate and human rights record.

“The Trans Mountain tar sands pipeline threatens my nation and our sacred Sleilwaut (Burrard) inlet; our place of creation. The pipeline poisons our clam beds and violates the rights of many indigenous communities along its length and at its source. It also affects communities in California because, with increased tar sands production, refineries in the East Bay are escalating their grave risks to community health and safety, including impacting the air quality. To date, 16 companies have ruled out insuring the Trans Mountain expansion, but some of the biggest U.S. insurers like Liberty Mutual and Travelers have refused to rule out support for the destructive pipeline. Insurers urgently need to get the message: it’s time to move away from dirty fossil fuels and instead uplift Indigenous rights, a healthy environment, and a stable climate.”

Zero U.S. insurers have adopted policies to protect the Free, Prior, and Informed consent of Indigenous Peoples affected by projects they insure.No major U.S. insurance companies, which make up the biggest share of oil and gas insurance around the globe, have published statements about Indigenous rights, let alone policies ensuring that their clients obtain the Free, Prior, and Informed consent of impacted Indigenous communities.

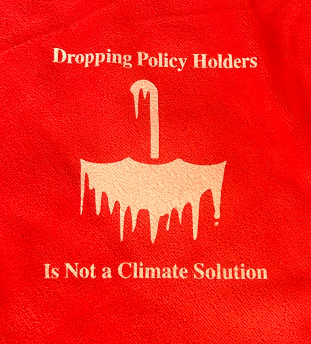

Furthermore, California, where the conference is taking place, is facing increasingly severe wildfires and droughts. The insurance industry’s response has been to abandon vulnerable communities and raise insurance costs exorbitantly.

Hundreds of thousands of people lost coverage as a result of insurance companies backing out of areas threatened by wildfires. A moratorium temporarily protected some homeowners, but it expired in September, allowing insurance companies to once again drop clients. Up to 2.4 million homes statewide could lose their protection; Chubb has already announced that it will be pulling back sharply in the state.

“As climate disasters threaten the health and safety of Californians, insurance companies’ response is to abandon vulnerable communities and raise insurance costs exorbitantly. At the same time, these companies are funding and providing insurance for fossil fuel companies that drive more frequent and intense wildfires. The hypocrisy is astounding. The public deserves to know whether their insurers are supporting fossil fuels, and the State of California needs this information to effectively analyze insurers’ climate risk management.”

At the same time, insurers stand behind their fossil fuel clients who are driving the climate crisis. While most major U.S. insurers have policies restricting support for coal, they have failed to follow the lead of European insurers and begin ruling out support for conventional oil and gas expansion. Five U.S. insurers have restricted insuring coal projects and/or companies, and four have limited insuring tar sands, but none have done the same for conventional oil and gas. This flies in the face of scientific consensus from IPCC and IEA that to avoid climate catastrophe, there must be no expansion of fossil fuels.

“Despite the intensifying impacts of wildfires, floods, and other climate change-fueled natural disasters on communities around the globe, U.S. insurers are continuing to plow ahead with their insurance services business as usual. While leading global insurers have adopted policies ruling out insurance for new fossil fuel projects, Chubb, Liberty Mutual, Travelers, and other U.S. insurers are providing a lifeline to the struggling coal industry and unrestricted support for the buildout of oil and gas infrastructure that contaminates drinking water, pollutes air, and destroys the climate."

Insurers’ failure to address the risks posed by their contributions to climate change has even captured the attention of shareholders, who for the first time have mounted a broad challenge to U.S. insurers for their contributions to climate change. Investor Green Century Capital Management filed resolutions at three insurance companies, Chubb, Travelers, and The Hartford, calling on them to stop underwriting new fossil fuel projects.

The coalition protesting at RIMS demanded that the U.S. insurance industry do the following to mitigate climate risk:

- Immediately stop insuring any new fossil fuel projects;

- Phase out insurance coverage for coal, oil, and gas;

- Adopt policies to ensure that any project they insure has obtained the Free, Prior, and Informed Consent of impacted Indigenous communities.