WASHINGTON (March 25, 2021)–A letter spearheaded by Senator Sheldon Whitehouse (D-RI) asks AIG, Berkshire Hathaway, Chubb, Liberty Mutual, Travelers and other US insurers to explain how their fossil fuel underwriting and investment policies align with their sustainability commitments. The letter was also signed by Senators Jeff Merkley (D-OR), Elizabeth Warren (D-MA), and Chris Van Hollen (D-MD). The letter was first reported in Politico Pro.

The letter represents the first time U.S. senators have publicly called on the U.S. insurance industry to account for its role in the climate crisis. AIG, Chubb, Liberty Mutual and Travelers are among the top insurers of fossil fuels worldwide, enabling the construction of new coal mines and oil pipelines.

“An increasing number of your competitors have stopped underwriting coal and other fossil fuel projects and/or restricted their investments in coal and certain dirty and environmentally damaging oil and gas projects such as tar sands,” the letter reads.

To date, at least 26 insurance companies globally have ended or limited their coverage for coal projects. As a result, coal projects face rate increases of up to 40% and struggle to find insurance, but U.S. insurers continue to provide a lifeline to the industry.

“As U.S. insurers fall further behind, it’s good to see U.S. senators calling them out for their failures and pressuring them to act,” said David Arkush, director of Public Citizen’s Climate Program. “Reading between the lines, the letter asks why they aren’t taking climate more seriously. There’s no good answer.”

The letter also notes the significant financial risks climate change poses to insurance companies’ financial viability, including through rising sea levels and coastal storms, more frequent and intense wildfires, and droughts and heatwaves. Worldwide, natural disasters caused $82 billion in insured losses in 2020.

The letter follows comments from Federal Reserve Governor Lael Brainard earlier this week highlighting the risk that climate harms could spark a financial crisis rooted in the property and casualty insurance sector, as insurers abruptly raise prices and decline to renew policies.

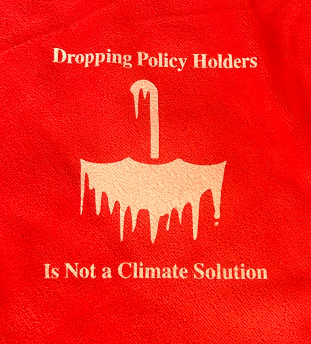

“Unlike their global competitors, U.S. insurers plan to keep fueling the climate crisis, then dump their customers when the fires come too close to home,” said Ross Hammond from the Insure Our Future campaign. “Their recklessness puts the lie to claims that they’re experts at managing risk, they’re environmental stewards, or even that they value their customers.”

Senator Whitehouse has long been a champion of reducing dependence on fossil fuels. He and his colleagues join a growing chorus of voices calling on the U.S. insurance industry to use its power to hasten the shift to renewables, including businesses, municipalities, Indigenous Peoples, and NGOs.

***

Insure Our Future is a U.S. campaign comprising environmental, consumer protection, and grassroots organizations holding the U.S. insurance industry accountable for its role in the climate crisis. It is part of the global Insure Our Future campaign, which promotes a rapid shift of the insurance industry from supporting and financing fossil fuels to accelerating the transition to a clean energy economy.