Companies backing 1.5°C target make up a quarter of top oil & gas insurers

Thursday, June 18 – Insurers must end all support for new oil and gas projects in order to meet international climate targets, NGOs supporting the Unfriend Coal / Insure Our Future campaign say in a letter to CEOs released today.

“Insurers have a responsibility to support international climate targets and align their businesses with the Paris Agreement,” said the letter, signed by 18 international NGOs including 350.org, Greenpeace, and Oil Change International. “As governments plan the recovery from the COVID-19 crisis insurers need to champion the transition to a sustainable, fair, and resilient future as underwriters, investors, and corporate citizens.”

Today, the campaign also released research revealing that four of the 15 biggest oil and gas insurers are companies that have publicly backed the Paris Agreement target of limiting global warming to 1.5°C, while seven have already limited support for fossil fuels by restricting insurance for coal. Additionally, the new report finds that the oil and gas insurance market is dominated by North American insurers.

“The science is clear that polluting industries need to shrink rapidly if we are to ensure a livable climate, and yet fossil fuel corporations and governments are pushing for the expansion of oil and gas across North America,” said Elana Sulakshana, Energy Finance Campaigner at Rainforest Action Network. “The U.S. insurance industry must say no to insuring all new oil and gas projects, stop providing a lifeline to the fossil industry, and accelerate a just transition to a clean energy future.”

NGOs supporting the Unfriend Coal campaign have focused their activities on campaigning for insurers to stop underwriting and investing in coal, but they are now widening the campaign to cover all fossil fuels that are inconsistent with international climate targets. To mark the change the campaign is rebranding as Insure Our Future – the label under which it has operated in the United States since 2018.

Since the Unfriend Coal campaign launched three years ago, 19 major insurers have adopted policies to end or limit insurance for the coal industry. These insurers control over 13.6% of the primary insurance market and 47.6% of the reinsurance market. Insurers have also divested coal from roughly $9 trillion of investments – over one-third (37%) of the industry’s global assets.

Peter Bosshard, Global Coordinator of the Unfriend Coal / Insure Our Future Campaign, said: “The massive disruption of the fossil fuel industry due to COVID-19 offers an opportunity to accelerate the required low-carbon transition. At a time when powerful governments are bailing out politically well-connected oil and gas companies, the insurance industry needs to stand up as a voice of reason and bring scientific evidence into the decision-making process about high-carbon projects.”

The Unfriend Coal / Insure Our Future letter is addressed to the CEOs of 27 leading property & casualty insurers and 3 leading insurance investors. It calls on them to:

- Immediately cease insuring new oil or gas expansion projects;

- Commit to phasing out insurance for oil and gas companies in line with a 1.5°C pathway;

- Immediately cease insuring new coal projects and coal companies;

- Divest all assets from oil, gas and coal companies that are not in line with a 1.5°C pathway;

- Bring stewardship activities in line with a 1.5°C pathway in a transparent way, including forceful advocacy for a green and just recovery from COVID-19.

Michael Mann, Distinguished Professor and Director of the Earth System Science Center, Penn State University, said: “Climate change is not a distant and far-off threat. Unprecedented weather extremes are impacting communities right now, and the insurance industry is already reeling from these climate-fueled disasters. It makes no sense for insurers to underwrite the industries that are most responsible for the warming of our planet. Insurance companies – which claim to be proponents of scientific rigor and risk management – must stop insuring coal, oil, and gas expansion and phase out all fossil fuel business in line with 1.5°C.”

The UN Intergovernmental Panel on Climate Change (IPCC) has warned that if global temperature increases are to be limited to 1.5°C without relying on carbon capture and storage technologies yet to be proven viable, oil consumption must decrease by 37% by 2030 and 87% by 2050. Gas consumption must decrease by 25% by 2030 and 74% by 2050.

Oil Change International has found that CO2 emissions from the oil, gas, and coal in existing fields and mines will push the world far beyond 1.5°C of warming and will exhaust a 2°C carbon budget. However, governments are planning to increase oil production from 100 to 120 million barrels per day (mb/d) between now and 2040 – three times the level of about 40 mb/d which is compatible with limiting global warming to 1.5°C.

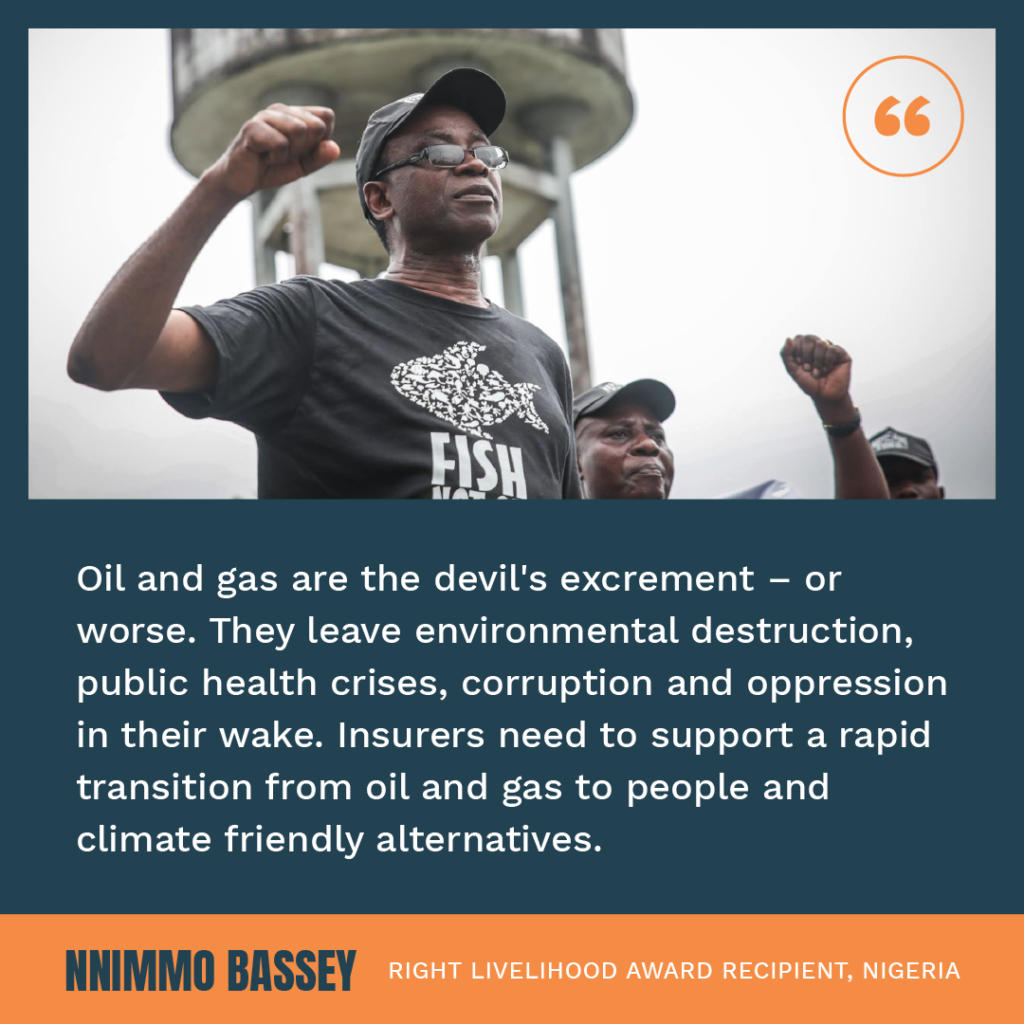

Nnimmo Bassey, Director of the Health of Mother Earth Foundation in Nigeria, said: “Oil and gas have often been described as the devil’s excrement. Some think they are actually worse. In countries around the world, they leave environmental destruction, public health crises, corruption and oppression in their wake. Insurance companies need to support a rapid transition from oil and gas to people and climate friendly alternatives.”

The letter was sent to 30 insurance CEOs, including 10 in the US: AIG, AXIS Capital, Berkshire Hathaway, Chubb, The Hartford, Liberty Mutual, MetLife, Travelers, TIAA and W.R. Berkley.