AS MASSIVE ENERGY INSURER LLOYD’S DITCHES COAL, TAR SANDS, & ARCTIC EXPLORATION, U.S. INSURERS CONTINUE BURNING THE PLANET DOWN

London, UK – On December 17, Lloyd’s of London will release its Environmental, Social and Governance Report which asks Lloyd’s member companies to no longer provide new insurance cover for coal-fired power plants, thermal coal mines, tar sands and new Arctic energy exploration by 2022 and phase out coverage for these sectors entirely by 2030. Although the timeline is far too slow and some key details remain unclear, the announcement from Lloyd’s highlights the ever-growing gap between U.S. insurance companies and their global peers on climate action.

The Lloyd’s policy, which also includes a commitment to divest from coal, tar sands, and Arctic drilling companies, comes on the heels of Insure Our Future’s fourth annual Scorecard on Insurance, Fossil Fuels and Climate Change. The scorecard highlighted the increasingly key role that U.S. insurers play in enabling the expansion of fossil fuels globally. Insuring any new coal, oil, or gas project is fundamentally incompatible with the goals of the Paris Agreement, and yet U.S. insurers are continuing to underwrite fossil fuel expansion with few limitations.

With this announcement, however, AIG, Liberty Mutual, and all of the other U.S. insurers that operate Lloyd’s syndicates will have to apply these restrictions to their underwriting business in the Lloyd’s marketplace.

Elana Sulakshana, Energy Finance Campaigner at Rainforest Action Network, commented: “Lloyd’s is sending a message to the U.S. insurance industry that it cannot continue its unchecked support for climate-wrecking projects under the Lloyd’s name. Building on today’s momentum, we will continue pressuring the U.S. insurance industry to match and exceed Lloyd’s policies across their entire fossil fuel underwriting and investment portfolios.”

U.S. companies continue to lag behind their global peers in terms of climate ambition: 4 of 10 U.S. companies examined in the 2020 scorecard have no coal policy whatsoever; the remaining 6 have policies riddled with loopholes.

David Arkush, Climate Program Director at Public Citizen, said: “The writing is on the wall – coal is becoming increasingly uninsurable. Lloyd’s announcement makes AIG’s & Travelers’ refusal to even consider dumping coal even more inexcusable. These companies can talk all they want about sustainability, but until they change their underwriting policies, that talk is meaningless.”

Although the Lloyd’s policy addresses tar sands oil and Arctic exploration, two carbon-intensive sectors that pose grave threats to Indigenous rights, it does not necessarily rule out Lloyd’s syndicates continuing to insure the Trans Mountain tar sands pipeline or oil and gas drilling in the Arctic National Wildlife Refuge due to ambiguous definitions for “oil sands” and “Arctic energy exploration,” as well as the long timeline for implementation.

Kanahus Manuel, a Secwepemc and Ktunaxa land defender with the Tiny House Warriors, said: “Insurance companies that continue to underwrite existing tar sands projects and pipelines infrastructure, including the Canadian-owned Trans Mountain pipelines, are guilty of Indigenous human rights violations. This policy and others that follow suit must include ‘existing’ tar sands projects and infrastructure, including pipelines.”

The Gwich’in Steering Committee is urging insurers to rule out underwriting oil and gas exploration and development in Alaska’s Arctic National Wildlife Refuge, as the Trump administration rushes ahead with lease sales for the region, scheduled for January 6, 2021. The Trump administration is also rushing to approve a seismic permit that would cause devastating impacts on the area. Almost thirty global financial institutions, including all major U.S. and Canadian banks, have adopted policies restricting financing for Arctic drilling projects. Swiss Re was the first insurer to publicly respond to the letter, joining AXA as a leader in prohibiting insurance for this risky project.

Bernadette Demientieff, Executive Director for the Gwich’in Steering Committee, said:

“Today’s announcement from Lloyd’s is a step in the right direction. However, it is not enough. As Indigenous Peoples, we are living in ground zero of climate change while fighting to protect our sacred lands and our ways of life. People need to understand that the land, the water, and the animals are what makes us who we are. We honor what Creator blessed us with and will stand united to protect it. Our human rights have been violated not just by our government but by corporations and people that are not educated on Indigenous issues. We urge Lloyd’s to join AXA and Swiss Re to exclude themselves from any Arctic Refuge energy development or exploration immediately and show the world that they respect the rights of Indigenous Peoples whose lives will forever change if drilling is to occur.”

Background:

The Lloyd’s announcement comes in the context of a larger movement among insurers, banks, asset managers, and other financial actors to distance themselves from fossil fuels. Earlier this month, New York State announced that it was divesting its $226 billion pension fund from fossil fuel stocks.

Prior to the Lloyd’s announcement, at least 24 insurance companies globally had ended or limited their coverage for coal projects, representing nearly half the global reinsurance market. This includes Fidelis’ announcement earlier this week. Nine insurers had limited or ended cover for tar sands.

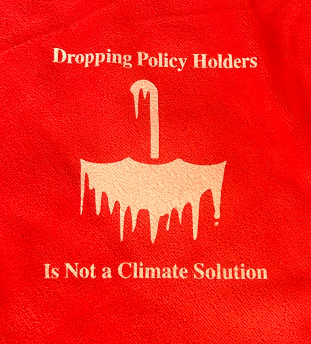

US insurers have come under increased scrutiny from the public sector, Indigenous Peoples and NGOs for their role in underwriting the damaging oil pipelines and coal mines driving climate change. In September, in an industry first, 60 businesses called on U.S. insurers to drop fossil fuels. And U.S. Congresswoman Ayanna Pressley—the representative for Liberty Mutual’s district—recently slammed the company for supporting fossil fuels.

The UN has warned that we have less than 10 years to transition away from fossil fuels if we are to prevent climate catastrophe. Yet as of July 2020, more than 737 gigawatts of new coal power are planned or under construction worldwide, the equivalent of 368 Hoover Dams. Coal remains the single biggest contributor to climate change.

***

Insure Our Future in the U.S. is a campaign comprising environmental, consumer protection, and grassroots organizations holding the U.S. insurance industry accountable for its role in the climate crisis. We are part of the global Insure Our Future campaign, which promotes a rapid shift of the insurance industry away from supporting and financing fossil fuels to accelerating the transition to a clean energy economy.

For more information, contact: Sulakshana, sulakshana@ran.org