New report shows 46% of reinsurance market and 37% of industry’s global assets now covered by coal exit policies

Dec. 2nd, 2019 – The number of insurance companies withdrawing coverage for coal has more than doubled in 2019 as the industry’s retreat from the sector accelerates and spreads beyond Europe, the Unfriend Coal campaign revealed in Insuring Coal No More, its third annual scorecard on insurance and climate change. However, the report finds that even with the first U.S. coal and tar sands policies announced in 2019, the U.S. industry still lags far behind its European peers.

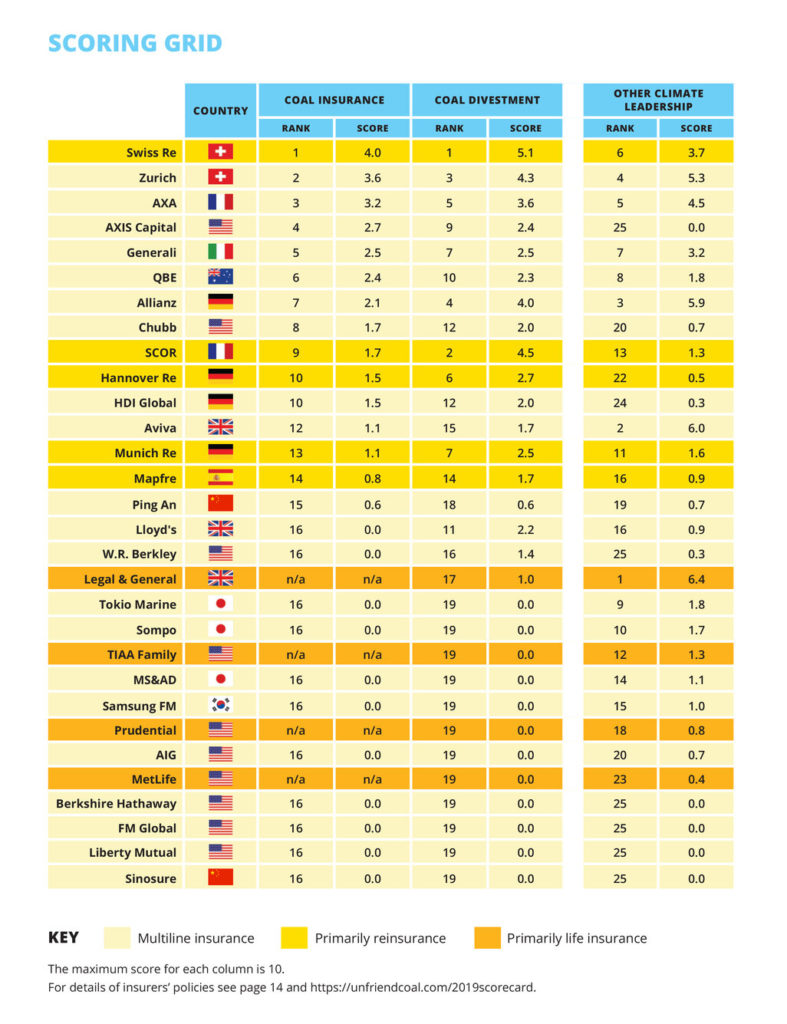

Coal exit policies have been announced by 17 of the world’s biggest insurers which control 46% of the global reinsurance market and 9.5% of the primary insurance market. Most refuse to insure new mines and power plants, while companies that scored highest in the report, like Swiss Re and Zurich, also ended coverage for existing coal projects and the companies that operate them, and have adopted similar policies for tar sands.

The U.S. insurance industry saw its first climate policies this year, with Chubb announcing a coal policy and AXIS Capital announcing a coal and tar sands policy. However, the U.S. still lags far behind its European counterparts. Liberty Mutual, AIG (NYSE: AIG), and Berkshire Hathaway (NYSE: BRK.A) have made no progress on climate change, ranking at the bottom of the 30 companies assessed. Seven of the 10 lowest ranking companies are based in the United States, while European firms make up seven of the 10 highest ranking companies.

“As global actors, U.S. insurance companies have a huge role to play in curbing the worst impacts of climate change. We are encouraged by initial leadership this year from Chubb and AXIS Capital, but the U.S. industry is still so far behind Europe,” said Lindsey Allen, Executive Director of Rainforest Action Network. “All eyes are now on Liberty Mutual, which is abandoning its long-time clients in the midst of ever increasing climate-related disasters, while simultaneously insuring fossil fuel companies that drive these crises. The company’s hypocrisy is shocking.”

The number of insurance companies divesting from coal has also increased dramatically in 2019. At least 35 companies with combined assets of roughly $8.9 trillion – 37% of the industry’s global assets – have now adopted coal divestment policies. This is up from 15 companies with $4 trillion assets under management in 2017 and 19 with $6 trillion in 2018.

“The role of insurers is to manage society’s risks. It is their duty and in their own interest to help avoid climate breakdown. The industry’s retreat from coal is gathering pace as public pressure on the fossil fuel industry and its supporters grows,” said Peter Bosshard, coordinator of the Unfriend Coal campaign and author of the report. “However, major US and Asian insurers continue to undermine international climate targets by insuring and investing in coal projects. All responsible companies must make coal uninsurable by ending support for both new and existing mines and power plants, including the Adani Group’s destructive Carmichael mine in Australia.”

Insurance companies’ action on coal is causing tangible impacts. Insurance brokers report that the cost of insuring coal is increasing as the market shrinks. In September 2019, UK broker Willis Towers Watson described an “increasing and worrying trend for insurers to withdraw from what they consider to be environmentally unfriendly industries such as coal,” warning that this trend “leaves very few primary markets for coal miners to turn to.”

Insuring Coal No More: The 2019 Scorecard on Insurance, Coal and Climate Change is published by 13 civil society organisations from 10 countries. It will be launched to an industry audience at the Insurance and Climate Risk conference in London as the 2019 UN Climate Summit commences in Madrid.

The scorecard ranks 30 leading insurers on their action on coal and climate change, assessing and scoring their policies on underwriting, divestment, and other aspects of climate leadership. It is based on responses to a survey that 24 of the 30 companies filled out, as well as publicly available information.

##

Read the full global report.

A summary for U.S. context is available here

For further information, pictures, graphics, and to arrange interviews, please contact:

Myriam Fallon, myriam@sunriseproject.net, 1.708.546.9001

NOTES TO EDITORS

About Unfriend Coal

The Unfriend Coal campaign brings together a global network of NGOs and social movements calling for insurance companies to divest from and cease insuring coal and support the transition to clean energy. Insuring Coal No More: The 2019 Scorecard on Insurance, Coal and Climate Change is co-published by: 350.org, ClientEarth (United Kingdom), Foundation Development YES – Open-Pit Mines NO (Poland), Friends of the Earth France, Greenpeace, Instituto Internacional de Derecho y Media Ambiente (Spain), Japan Center for a Sustainable Environment and Society (Japan), Market Forces (Australia), Rainforest Action Network (USA), Re:Common (Italy), Solutions for Our Climate (Korea), The Sunrise Project (Australia), Urgewald (Germany)